Why does health care cost so much? The answer to that question is fairly complicated. There are many factors contributing to rising costs, with new cost drivers emerging all the time, making affordability a growing challenge for families and employers.

But when it comes to where your insurance premium dollars go, that’s a lot more straightforward. At Blue Cross and Blue Shield of North Carolina (Blue Cross NC), we closely monitor this every day, ensuring those dollars are spent responsibly and delivering maximum value.

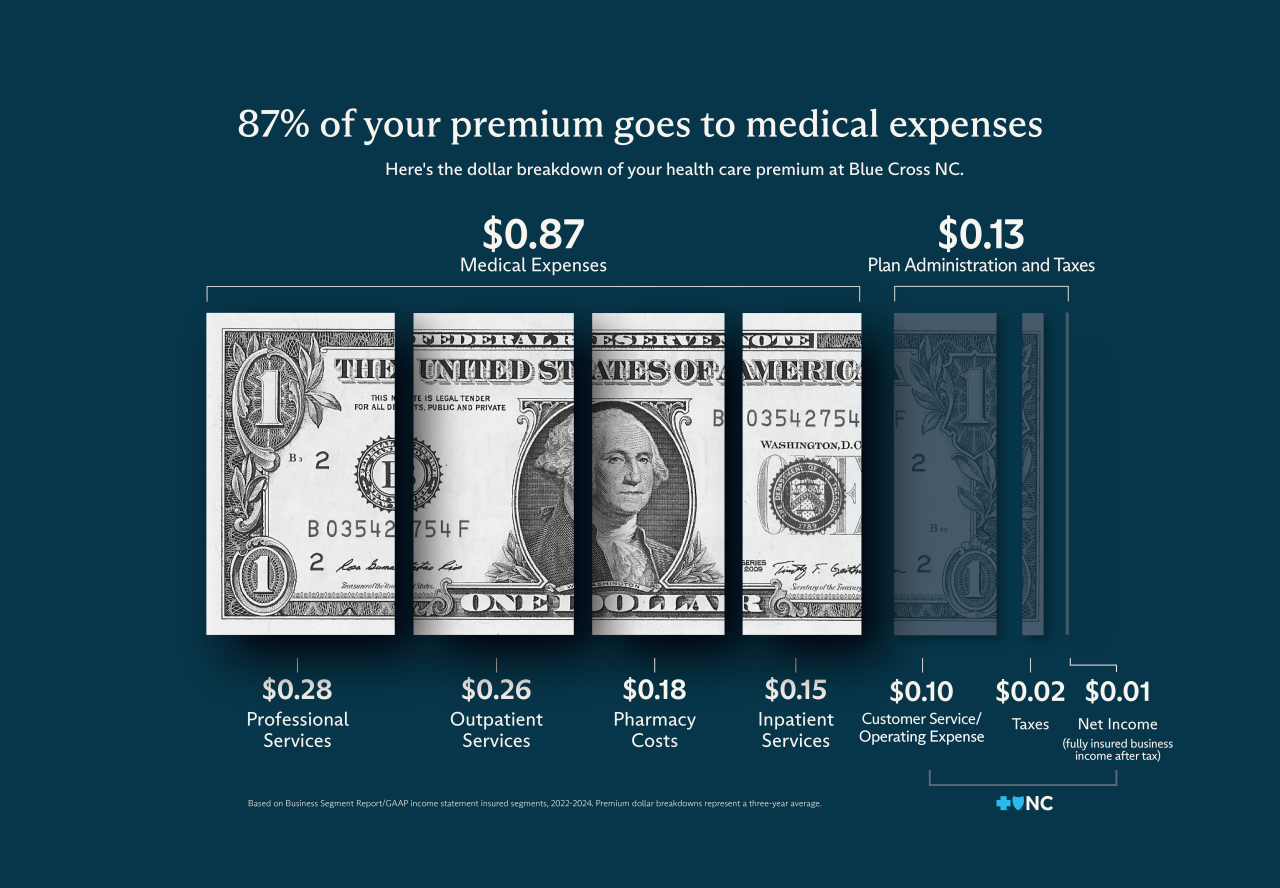

As part of our commitment to transparency, we routinely report how we allocate premium dollars. This breakdown reflects our spending from 2022 to 2024 and offers a general overview of how each dollar is used to support care, prescription drugs, and operations. While individual health plans may vary, this snapshot gives a clear picture of how Blue Cross NC invests in our members’ health.

Let’s dig a little deeper to see what each of these expenses really means.

What it covers: Payments to doctors, specialists, and other licensed health care providers for diagnosis, treatment, and routine care.

Examples:

- Primary care visits (e.g., annual physical)

- Specialist consults (e.g., dermatologist, cardiologist)

- Mental health therapy sessions

- Telehealth consultations

Not surprisingly, this represents the largest expense in health care. This will always be the case, with most of our members’ health care dollars going directly to the care they receive. As the largest share of costs, it’s vital that we work together to find ways to get more value out of every dollar. That’s why we’re focused on driving more value from every visit, including regular preventive care to bring down costs by reducing the incidence of expensive chronic diseases.

What it covers: Medical care that doesn’t require an overnight hospital stay.

Examples:

- MRI or CT scans at an imaging center

- Same-day surgeries (e.g., cataract removal)

- Physical therapy sessions

- Urgent care visits

Similar to professional services, these are front-line medical services, claiming a similar share of expenses. As costs can vary widely for some procedures, there are levers consumers can pull to lower costs here. MRI prices, in particular, are all over the map and can vary by hundreds of dollars depending on where the procedure is conducted. We’re working to help members make informed choices about out-of-pocket costs.

What it covers: Prescription medications and pharmacy benefits, based on your plan.

Examples:

- Prescription drugs (e.g., amoxicillin)

- Specialty drugs (e.g., biologics for rheumatoid arthritis)

- Insulin for diabetes

- Prescriptions filled through specialty pharmacies

Pharmacy costs are rising at an alarming pace, driven by factors like specialty drug pricing and increased utilization. Even if they represent a smaller portion of the premium dollar compared to other categories, their rapid growth poses a serious challenge to affordability. At Blue Cross NC, we’re taking action and seeing some success in helping to offset these increases and improve outcomes for our members with collaborations like our medication adherence initiative with Sempre.

What it covers: Hospital stays that involve overnight admission.

Examples:

- Surgery with post-op hospital recovery

- Childbirth/delivery in a hospital

- ICU care for serious illness

- Inpatient rehabilitation after a stroke

The rising cost of labor for hospitals continues to be a significant cause of inpatient care price hikes. At the same time, public payer reimbursements from Medicare and Medicaid continue to lag behind the inflation rate, creating financial strain for hospitals. Blue Cross NC continues to collaborate with health care providers to support sustainable care delivery while managing affordability for our members.

What it covers: Administrative costs related to running the health plan.

Examples:

- Employee labor costs

- Call center staff helping members with claims or benefits

- Claims processing systems and software

- Marketing and enrollment operations

- Communications and enrollment operations

- Compliance, legal, and regulatory costs

This is perhaps where Blue Cross NC has the most potential to control costs. As a fully-taxed not-for-profit, Blue Cross NC reinvests in technology, service, and innovation, all while keeping administrative spending lean. In fact, Blue Cross NC spends 87 cents of every premium dollar on our members’ medical bills, exceeding the legally required 80 cents.

You’ve been hearing for years that rising health care costs are unsustainable. And now we’ve reached a true crisis point. The system could ultimately collapse under the weight of its own costs.

Blue Cross NC is sounding the alarm not just to highlight the problem, but to lead the conversation around solutions. The future of our health care system depends on bold action, smart partnerships, and a shared commitment to making care more accessible and sustainable for everyone.

Blue Cross and Blue Shield of North Carolina does not discriminate on the basis of race, color, national origin, sex, age or disability in its health programs and activities. Learn more about our non-discrimination policy and no-cost services available to you.

Information in other languages: Español 中文 Tiếng Việt 한국어 Français العَرَبِيَّة Hmoob ру́сский Tagalog ગુજરાતી ភាសាខ្មែរ Deutsch हिन्दी ລາວ 日本語

© 2026 Blue Cross and Blue Shield of North Carolina. ®, SM Marks of the Blue Cross and Blue Shield Association, an association of independent Blue Cross and Blue Shield plans. All other marks and names are property of their respective owners. Blue Cross and Blue Shield of North Carolina is an independent licensee of the Blue Cross and Blue Shield Association.