You’re not alone in asking: Why does it have to be so hard? Why is it so complex – and so expensive? The truth is, many factors outside of your control (and ours) affect what you pay.

At Blue Cross and Blue Shield of North Carolina (Blue Cross NC), we know rising health care costs are frustrating – and confusing. Here’s a look at what’s driving changes for individual ACA (Affordable Care Act) plans in 2026 – and what we’re doing to help.

When healthier people leave the ACA Marketplace, the people who stay often need more care. That makes costs go up for everyone.

Since 2021, many people have received extra savings, called enhanced premium tax credits, from the federal government to offset the cost of their ACA health plans. But starting in 2026, those extra savings are going away.

However, while the enhanced premium tax credits are going away, other federal subsidies, which have been in effect since 2014, will still be in place in 2026. Use our subsidy calculator to see if you qualify for one of these subsidies.

Starting in 2026, new federal regulations may change who qualifies for ACA plans. If fewer healthy people stay in the market, costs could go up for those who remain.

Like everything else, health care is getting more expensive. Hospital services, outpatient care, and medications are all seeing steep cost increases. In fact, industry experts project 2025 will bring the highest medical cost growth in over a decade – around 8% year-over-year.

Understanding what's driving costs can help you prepare for what’s ahead – and make confident decisions about your health plan.

We know you want to understand how your money is being spent—and you deserve transparency.

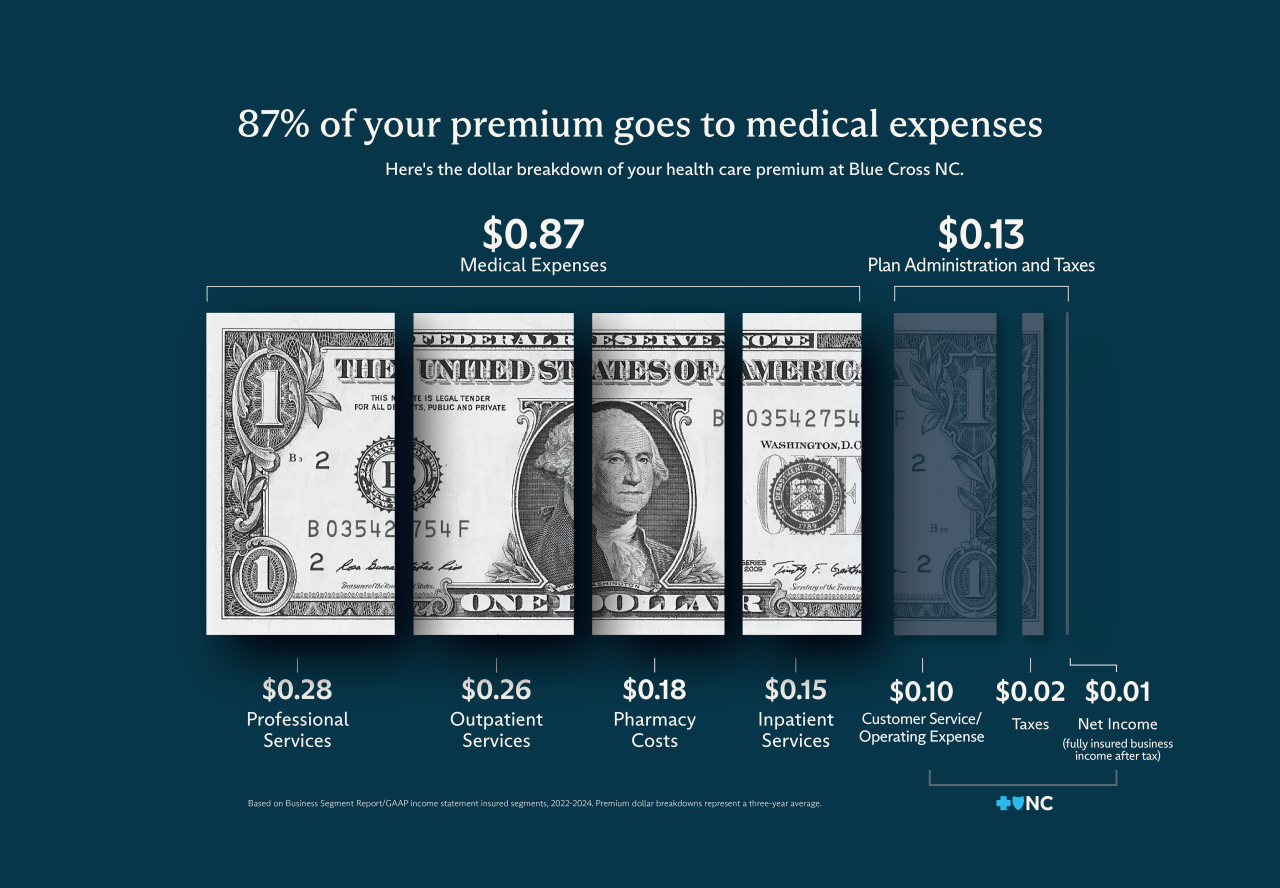

At Blue Cross NC, 87 cents of every premium dollar goes directly to your medical care.

Here’s the full breakdown:

By law we must spend at least 80% of your premium on your care. If we don’t, we return the difference to you. That’s called the Medical Loss Ratio (MLR), and it helps ensure you get value—not just coverage.

We’re working to build a health care system that works for you — not just for companies.

- Putting members first: As a purpose-driven, not-for-profit health insurer that doesn't answer to shareholders, we are doing more than making commitments. We’re making progress to advance care for all North Carolinians.

- Improving access to care: We’re making it easier for doctors to join our network and removing outdated rules that block care.

- Supporting you when it matters most: Our customer service team is here to help you understand your options and get the care you need.

- Helping you save money: We’re simplifying how members navigate their care by giving them tools to make informed, cost-saving decisions.

- Listening to our communities: We’re investing in big issues like youth mental health to improve care for all North Carolinians.

We know change can be hard. But you’re not in this alone. We’ll keep sharing updates as we get closer to 2026. In the meantime, you can:

- Visit enroll.bluecrossnc.com

- Call the number on your Blue Cross NC ID card

- Stop by one of our Beyond Blue Neighborhood Centers for help

- While enhanced subsidies are going away, you can check to see if you qualify for subsidies that will remain in place for 2026. Use this subsidy calculator.

Because you deserve care that’s simple, affordable, and built around your needs.

Blue Cross and Blue Shield of North Carolina does not discriminate on the basis of race, color, national origin, sex, age or disability in its health programs and activities. Learn more about our non-discrimination policy and no-cost services available to you.

Information in other languages: Español 中文 Tiếng Việt 한국어 Français العَرَبِيَّة Hmoob ру́сский Tagalog ગુજરાતી ភាសាខ្មែរ Deutsch हिन्दी ລາວ 日本語

© 2026 Blue Cross and Blue Shield of North Carolina. ®, SM Marks of the Blue Cross and Blue Shield Association, an association of independent Blue Cross and Blue Shield plans. All other marks and names are property of their respective owners. Blue Cross and Blue Shield of North Carolina is an independent licensee of the Blue Cross and Blue Shield Association.